IS-LM model/Tutorials: Difference between revisions

imported>Nick Gardner (New page: {{subpages}}) |

imported>Nick Gardner No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{subpages}} | {{subpages}} | ||

== The model == | |||

=== Equilibriums in the real market : IS curve === | |||

“IS” stands for “[[investment]] and [[saving]]”. The IS curve represents all equilibriums for which total spending (consumption and investment) equals total output (income). This equation is equivalent to the equality between investment and saving, which is a basic accounting equation in a closed economy. | |||

<center><math>Y=C+I</math></center> | |||

Investment is a decreasing function of interest rate. Indeed, the interest rate represents the [[opportunity cost]] of an investment. Higher is the interest rate, higher must be the return on investment. It implies that when the interest rate is high many investments whose profitability would be low are not undertaken. | |||

<center><math>Y=C+I(i)</math></center> | |||

I is a decreasing function of i, and so is Y. Then ''IS'' is a decreasing curve. | |||

=== Equilibriums in the monetary market : LM curve === | |||

“LM” refers to “Liquidity preference and money supply”. The LM curve represents all equilibriums where demand equals supply on the monetary market. | |||

According to Keynes, people hold liquidities for two reasons. | |||

*Citizens need cash for every day life transactions and because of uncertainty (they are cautious). Keynes calls those needs “transactions demand for money”. It is positively related to income (Y). | |||

*When people want to save they must choose between securities (financial markets) and money. Money can be considered as an asset among others and its price is the interest rate. Keynes suggests that when the interest rate seems too low, speculators expect it to rise and thus "buy" (by selling financial assets for example) or borrow money. On the contrary, when they think that the interest rate is too high, speculators expect it to drop and sell money (by buying financial assets for example). | |||

So, according to Keynes, demand for money includes transactions demand (L1) and speculative demand (L2). In equilibrium we have the following relationship. | |||

<center><math>\frac {M_o}{p}=L_1(Y)+L_2(i)\Leftrightarrow L_2(i)=\frac {M_o}{p}-L_1(Y)</math> | |||

And since | |||

<math>\begin{cases} L_2(i)\text{ is a decreasing function of }L_1(Y) \\ L_2\text{ is a decreasing function of }i \\ L_1\text{ is a increasing function of }Y \end{cases}\Leftrightarrow i \text{ is positively related to } Y</math> | |||

then ''LM'' is a increasing curve.</center> | |||

=== General equilibrium === | |||

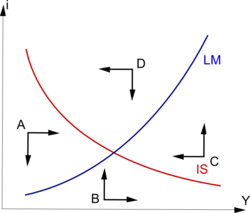

The general equilibrium is given by the intersection of ''IS'' and ''LM''. The level of income and the interest rate can diverge from their equilibrium level only on a temporary basis. Indeed, | |||

[[Image:ISLMequilibrium.png|right|250px]] | |||

*If the interest rate and the income are situated at ''point A'', then it means that in the goods and services market, supply is insufficient to balance demand. Prices will rise and so will production. It also means that demand is insufficient to balance supply on the monetary market which will make the interest rate fall. | |||

*At ''point B'', supply of goods and services is also insufficient and so is money supply. This combination implies a rise of both output and interest rate. | |||

*At ''point C'', supply exceeds demand in the real market, and then companies must reduce their output. The lack of money make interest rate rise. | |||

*At ''point D'', supply exceeds demand in both the real market and the monetary market. Both production and interest rate will drop. | |||

== Analysis of macroeconomic policies == | |||

According to Keynes, the labour market is not a market among others. The demand of labour (that is to say the demand of corporations for workers) is not always determined by the level of wages, but also by the aggregate demand (C+I=Y). During a recession, the aggregate demand may be insufficient to require all production factors (capital and labour). In this case, the economy can be in equilibrium with persisting unemployment. In such a situation, the State can stimulate the economy with macroeconomic policies without creating inflationary tensions. | |||

It can be noted that Keynes suggests implementing such measures in case of recession, while keynesian economists have then defended those policies as permanent regulation. | |||

===Slope of the curves=== | |||

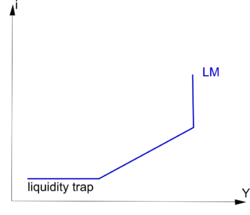

[[Image:SlopLM.png|right|250px]] | |||

The efficiency of macroeconomic policies is directly affected by the [[slope]] of LM and IS. For example, a [[liquidity trap]], which implies a flat ''LM'' curve, makes the monetary policy inefficient. | |||

The liquidity trap occurs when interest rates would be so low that everyone would expect them to rise. In this case, an infinite speculative demand would actually make them reach a more realistic level. Keynes concludes that interest rates cannot fall under a certain level whatever the income Y. In this situation, LM is horizontal. | |||

On the contrary, there is a level of interest rate for which speculators have lent all their money. There is no more saving to finance any expansion of the output. In this case, LM is vertical. | |||

In John Hicks views, the vertical part of ''LM'' corresponds to the general equilibrium of classical economics, while the horizontal part was purely keynesian. In fact, the IS-LM model was an extent of the Walrasian theory which had forgotten some particular cases described by Keynes. | |||

Between those extremes, expansions of the output are possible, but they increase the transactions demand for money and make interest rates rise. | |||

The slope of ''IS'' reflects the interest rate elasticity of investment, and thus the impact of the variations of the interest rate on the output. | |||

===Fiscal policy === | |||

A more detailed model can be made in order to understand the effects of government spending. In this model, G represents governmental spending, T taxes, C consumption of private agents and I investment of private agents. | |||

<center><math>Y=C+I(i)+G-T</math> | |||

If C is considered as a proportion of Y noted c, we obtain: | |||

<math>Y=cY+I(i)+G-T</math><br> | |||

<math>Y-cY=I(i)+G-T</math><br> | |||

<math>(1-c)Y=I(i)+G-T</math><br> | |||

<math>Y=(I(i)+G-T)/(1-c)</math></center> | |||

The last equation implies that if the government increases its spending (G) without increasing tax revenues (T), by creating a deficit, then the effect on the national output will be 1/(1-c) times greater. For example, if c=0,8, then an increase of 1 of G implies an increase of 1/(1-0,8)=5 of Y. This mechanism is known as the spending multiplier. | |||

In a few words, the government can change the level of Y by reducing or expanding the budget deficit. | |||

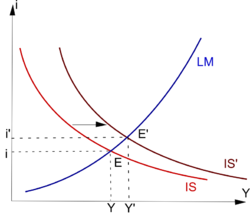

[[Image:ISLMfiscalexpansion.png|right|250px]] | |||

In the case of a expansionary fiscal policy, the government increases its purchases or reduces taxes, which creates a budget deficit and makes Y rise as explained before. This deficit shifts the ''IS'' curve to the right (Y rises). It results in a new general equilibrium (E'). The output Y has become Y' while the interest rate has risen from i to i'. By the way of higher interest rates, such a policy is said to crowd-out private investment. According to keynesian economics, this negative effect can be exceeded by the positive effect of the spending multiplier at the following conditions : | |||

*The marginal propensity to consumption (c) is high. Higher is the marginal propensity to consumption, more important is the spending multiplier. | |||

*the slope of the ''LM'' curve is low (important speculative demand for money). The importance of the speculative demand for money reduces the rise of interest rates linked to the expansion, and thus the crowding-out effect. | |||

*and the slope of the ''IS'' curve is high (low interest rate elasticity of investment). Private investments are not very affected by the rise of interest rates. | |||

*prices must be rigid. | |||

*Some factors of production must be avaible. | |||

A contractionary fiscal policy would have the opposite effects. | |||

=== Monetary policy === | |||

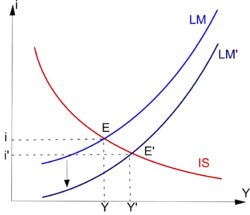

[[Image:ISLMmonetaryexpansion.png|right|250px]] | |||

The IS/LM model assumes that the monetary authority control the supply of money. If the supply of money is increased, then the price of money, ''i.e.'' the interest rate, will drop. A lower interest rate will stimulate investments and thus the output. | |||

On the graph, an expansionary monetary policy makes LM shifts down (drop of the interest rate). Such a measure is particularly efficient under the following conditions: | |||

*A low interest elasticity of the demand for money. In this case, an important decrease of the interest rate would be necessary if demand is to equal supply. | |||

*A high interest elasticity of investment so that the fall of the interest rate has a large effect on the output. | |||

*An important multiplier effect. | |||

*prices must be rigid. | |||

*Some factors of production are avaible. | |||

A contractionary monetary policy would have the opposite effects. | |||

Latest revision as of 00:36, 19 December 2009

The model

Equilibriums in the real market : IS curve

“IS” stands for “investment and saving”. The IS curve represents all equilibriums for which total spending (consumption and investment) equals total output (income). This equation is equivalent to the equality between investment and saving, which is a basic accounting equation in a closed economy.

Investment is a decreasing function of interest rate. Indeed, the interest rate represents the opportunity cost of an investment. Higher is the interest rate, higher must be the return on investment. It implies that when the interest rate is high many investments whose profitability would be low are not undertaken.

I is a decreasing function of i, and so is Y. Then IS is a decreasing curve.

Equilibriums in the monetary market : LM curve

“LM” refers to “Liquidity preference and money supply”. The LM curve represents all equilibriums where demand equals supply on the monetary market.

According to Keynes, people hold liquidities for two reasons.

- Citizens need cash for every day life transactions and because of uncertainty (they are cautious). Keynes calls those needs “transactions demand for money”. It is positively related to income (Y).

- When people want to save they must choose between securities (financial markets) and money. Money can be considered as an asset among others and its price is the interest rate. Keynes suggests that when the interest rate seems too low, speculators expect it to rise and thus "buy" (by selling financial assets for example) or borrow money. On the contrary, when they think that the interest rate is too high, speculators expect it to drop and sell money (by buying financial assets for example).

So, according to Keynes, demand for money includes transactions demand (L1) and speculative demand (L2). In equilibrium we have the following relationship.

And since

then LM is a increasing curve.

General equilibrium

The general equilibrium is given by the intersection of IS and LM. The level of income and the interest rate can diverge from their equilibrium level only on a temporary basis. Indeed,

- If the interest rate and the income are situated at point A, then it means that in the goods and services market, supply is insufficient to balance demand. Prices will rise and so will production. It also means that demand is insufficient to balance supply on the monetary market which will make the interest rate fall.

- At point B, supply of goods and services is also insufficient and so is money supply. This combination implies a rise of both output and interest rate.

- At point C, supply exceeds demand in the real market, and then companies must reduce their output. The lack of money make interest rate rise.

- At point D, supply exceeds demand in both the real market and the monetary market. Both production and interest rate will drop.

Analysis of macroeconomic policies

According to Keynes, the labour market is not a market among others. The demand of labour (that is to say the demand of corporations for workers) is not always determined by the level of wages, but also by the aggregate demand (C+I=Y). During a recession, the aggregate demand may be insufficient to require all production factors (capital and labour). In this case, the economy can be in equilibrium with persisting unemployment. In such a situation, the State can stimulate the economy with macroeconomic policies without creating inflationary tensions.

It can be noted that Keynes suggests implementing such measures in case of recession, while keynesian economists have then defended those policies as permanent regulation.

Slope of the curves

The efficiency of macroeconomic policies is directly affected by the slope of LM and IS. For example, a liquidity trap, which implies a flat LM curve, makes the monetary policy inefficient.

The liquidity trap occurs when interest rates would be so low that everyone would expect them to rise. In this case, an infinite speculative demand would actually make them reach a more realistic level. Keynes concludes that interest rates cannot fall under a certain level whatever the income Y. In this situation, LM is horizontal.

On the contrary, there is a level of interest rate for which speculators have lent all their money. There is no more saving to finance any expansion of the output. In this case, LM is vertical.

In John Hicks views, the vertical part of LM corresponds to the general equilibrium of classical economics, while the horizontal part was purely keynesian. In fact, the IS-LM model was an extent of the Walrasian theory which had forgotten some particular cases described by Keynes.

Between those extremes, expansions of the output are possible, but they increase the transactions demand for money and make interest rates rise.

The slope of IS reflects the interest rate elasticity of investment, and thus the impact of the variations of the interest rate on the output.

Fiscal policy

A more detailed model can be made in order to understand the effects of government spending. In this model, G represents governmental spending, T taxes, C consumption of private agents and I investment of private agents.

If C is considered as a proportion of Y noted c, we obtain:

The last equation implies that if the government increases its spending (G) without increasing tax revenues (T), by creating a deficit, then the effect on the national output will be 1/(1-c) times greater. For example, if c=0,8, then an increase of 1 of G implies an increase of 1/(1-0,8)=5 of Y. This mechanism is known as the spending multiplier.

In a few words, the government can change the level of Y by reducing or expanding the budget deficit.

In the case of a expansionary fiscal policy, the government increases its purchases or reduces taxes, which creates a budget deficit and makes Y rise as explained before. This deficit shifts the IS curve to the right (Y rises). It results in a new general equilibrium (E'). The output Y has become Y' while the interest rate has risen from i to i'. By the way of higher interest rates, such a policy is said to crowd-out private investment. According to keynesian economics, this negative effect can be exceeded by the positive effect of the spending multiplier at the following conditions :

- The marginal propensity to consumption (c) is high. Higher is the marginal propensity to consumption, more important is the spending multiplier.

- the slope of the LM curve is low (important speculative demand for money). The importance of the speculative demand for money reduces the rise of interest rates linked to the expansion, and thus the crowding-out effect.

- and the slope of the IS curve is high (low interest rate elasticity of investment). Private investments are not very affected by the rise of interest rates.

- prices must be rigid.

- Some factors of production must be avaible.

A contractionary fiscal policy would have the opposite effects.

Monetary policy

The IS/LM model assumes that the monetary authority control the supply of money. If the supply of money is increased, then the price of money, i.e. the interest rate, will drop. A lower interest rate will stimulate investments and thus the output.

On the graph, an expansionary monetary policy makes LM shifts down (drop of the interest rate). Such a measure is particularly efficient under the following conditions:

- A low interest elasticity of the demand for money. In this case, an important decrease of the interest rate would be necessary if demand is to equal supply.

- A high interest elasticity of investment so that the fall of the interest rate has a large effect on the output.

- An important multiplier effect.

- prices must be rigid.

- Some factors of production are avaible.

A contractionary monetary policy would have the opposite effects.